What is Khums?

Islam is a holistic religion. Along with spiritual responsibilities, every Muslim also has financial responsibilities. One of these financial responsibilities is Khums.

Khums is a twenty per cent obligatory Islamic tax on some items that we own, payable under specific conditions.

This is referenced in Holy Qur’an, verse 8:41, where it states:

“Know that whatever of a thing you acquire, a fifth of it is for Allah, for the Messenger, for the near relative, and the orphans, the needy and the wayfarer”

Khums, which literally translates to “one-fifth”, is an annual tax that is a form of charity parallel to Zakat. Khums is part of the Islamic economic system that aims to bring justice to society and strengthen humanity by requiring Muslims to donate 20% of their excess wealth, or savings.

How does it work?

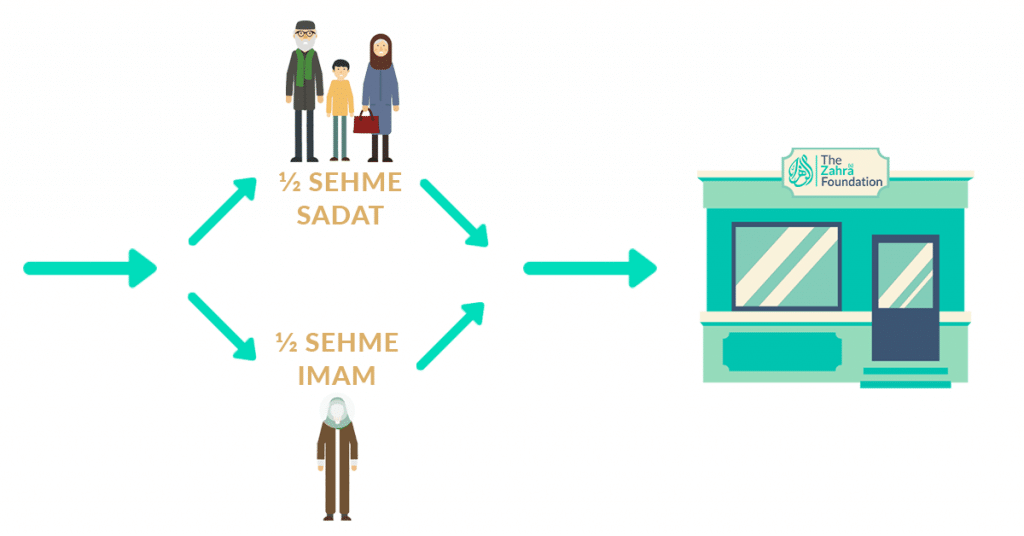

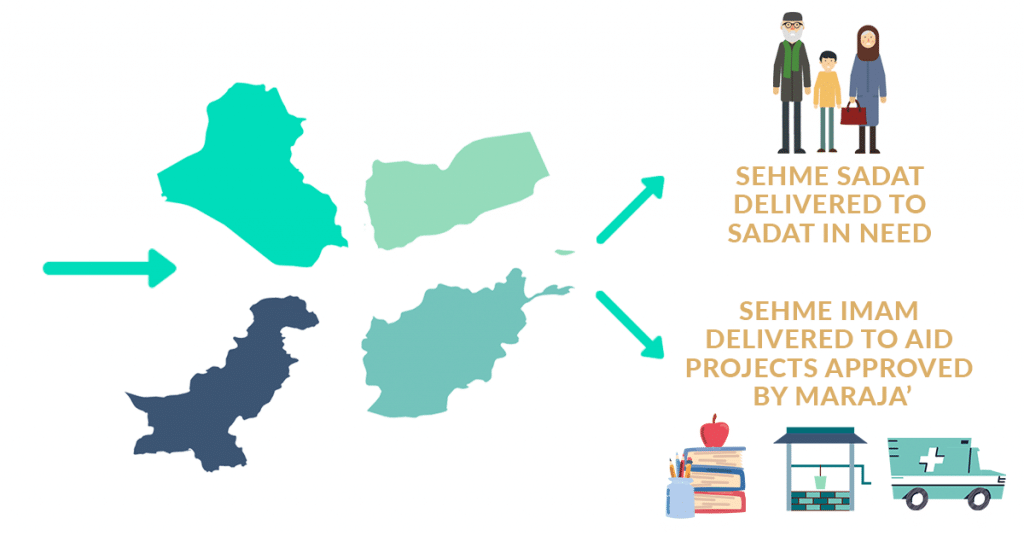

This is split into two portions, Sehme Imam and Sehme Sadaat. The Sehme Imam portion of Khums is delivered to projects approved by Maraja. The Sehme Saadat portion of Khums is delivered to Sadaat (descendants of the Prophet (SAW) in need.

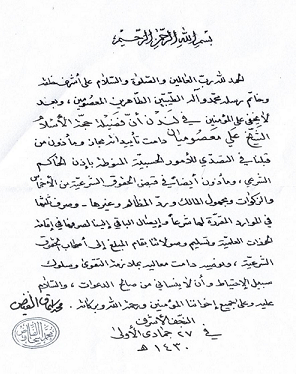

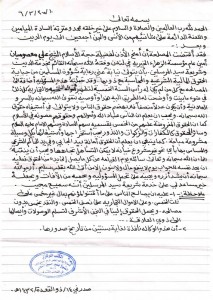

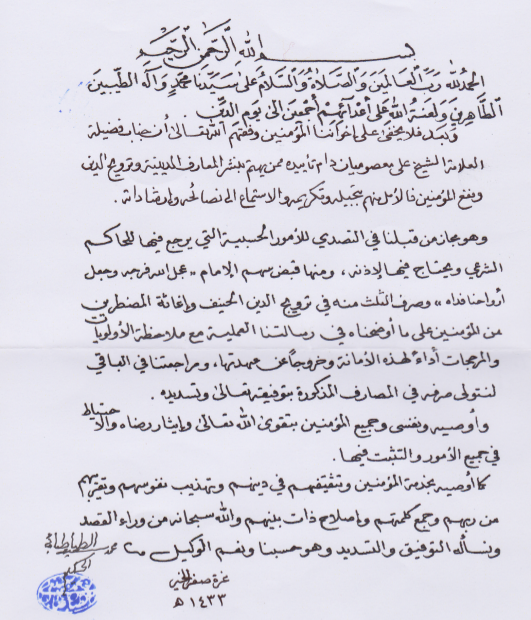

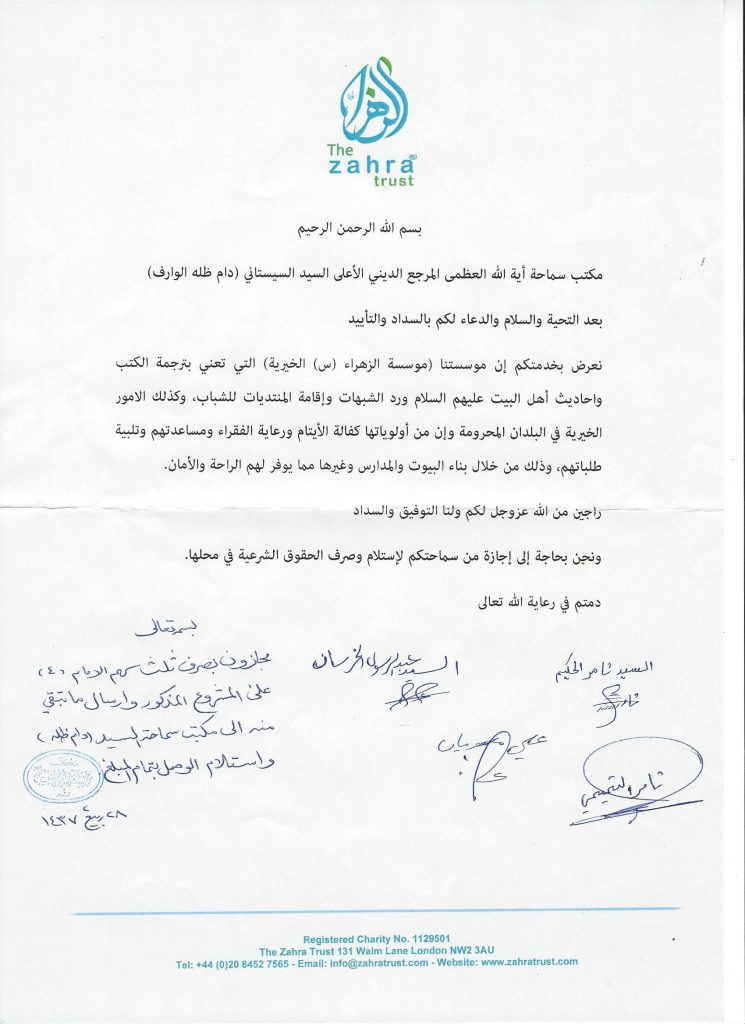

The Zahra Trust has permission to collect Khums from most of the leading Maraja including Ayatullah Sayed Ali al-Sistani, allowing us to distribute Khums funds towards our welfare projects and Sadaat in need.

Sehme Imam may go towards our Water Aid program, our country-based appeals (such as Afghanistan and Yemen), our Orphans, Widows & Vulnerable Children programme or other humanitarian projects. Sehme Sadaat will often be delivered to Sadaat orphans, widows and vulnerable children.

Fulfil your Khums Today!

FREQUENTLY ASKED QUESTIONS ABOUT KHUMS

“Know that whatever of a thing you acquire, a fifth of it is for Allah, for the Messenger, for the near relative, and the orphans, the needy and the wayfarer” (8:41). Allah (swt) in the Holy Quran outlines for us exactly the purpose of Khums.

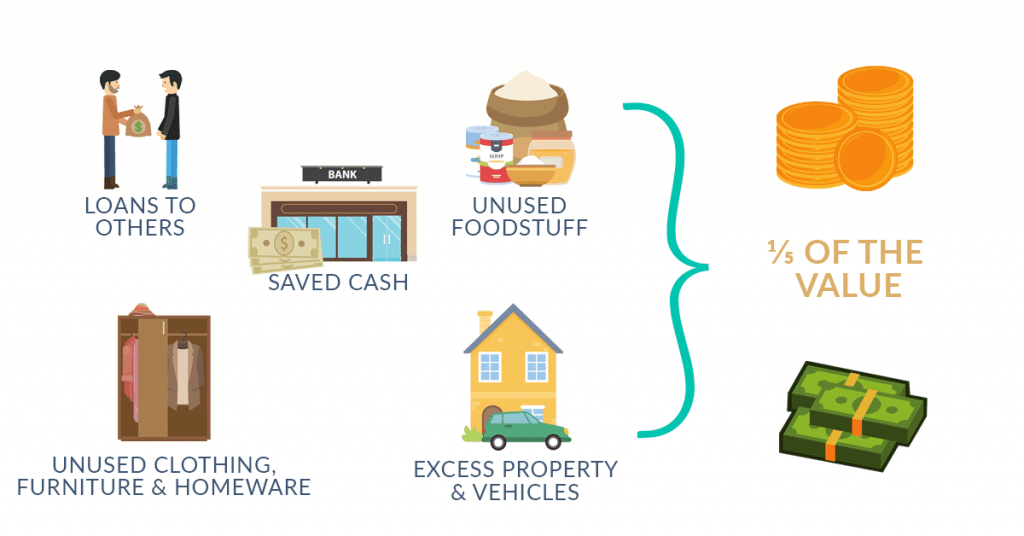

Essentially, all forms of income whether they be through work or inheritance are liable. They include net savings, haram and halal wealth, buried treasure, minerals, spoils of war, and gems obtained from sea diving. Some financial gains are only paid for Khums if unused for a year. These include inheritance, items such as clothing, household goods/provisions and property and savings that have not been used for a year.

Every individual Muslim who has reached the age of puberty and is of sound mind. For minors, it becomes the parents’ or guardians’ duty to pay it.

There are 2 ways a Muslim can pay Khums. First, they can pay Khums upon receipt of the gain immediately if this in excess of what they need. The second, which might be easier, is to fix an annual date as the Khums annual date. On this date, one should pay Khums on the surplus of what one has for the preceding year.

Khums can be calculated by dividing your possessions into categories.

Food: Whatever foodstuff exists in your possession, which is unused and which has a monetary value should be counted.

Clothing and furniture: Consider your unused or extra items acquired during the last year, and one-fifth of them should be paid as Khums.

Property: If you require, for example, two cars and you own three, you have to pay Khums on the third car. Or if you have a house which suffices your need, but you have purchased another home, the latter is considered a surplus of your needs and the Khums should be paid on it.

Cash: One-fifth of all money that is saved and is at hand needs to be paid as Khums.

Debts and loans: If your money is lent to someone else, after one-year, Khums becomes due on it.

You can also use our Khums Calculator to simplify your Khums calculation!

Khums can be paid in two ways. The first way is to give one-fifth of the commodity itself (i.e. if you have 5 kilos of rice, pay 1 kilo as Khums). The second way is to pay the cash equivalent according to the market value. So instead of giving the one kilo of rice, you pay its cash equivalent.

Your Marja will let you know where you can donate your Khums. The Zahra Foundation has Khums Ijaza from many leading Maraja including Ayatullah Sistani, Ayatullah Basheer Hussain Najafi, Ayatullah Ishaq al Fayadh and Ayatullah Sayed Al Hakim, meaning if you are a muqalid of any of these Maraja you can pay your Khums to The Zahra Foundation who will allocate the funds accordingly.

THE KHUMS PROCESS

1. Calculating Khums

2. Split of Khums into Sehme Imam and Sehme Sadat

3. Delivery of Khums to The Zahra(s) Trust Canada

4. Delivery of Khums by The Zahra(s) Trust Canada to the designated fund (Sehme Imam towards approved aid projects by Maraja’ and Sehme Sadat towards Sadat in need)